Introduction

Uruguay has 10 million deciduous fruit plants (DFP) distributed in 1267 farms with a predominance of family producers1. The sector is fragile and depends on sectoral protection and promotion policies for its survival. Fresh fruit supplies the domestic market and the industry to a lesser extent, reaching the consumer through several intermediation channels. A nucleus of producers with greater investment capacity reoriented their production towards exportable varieties. They integrated vertically operating as an intermediary and commercial service provider for both the domestic and export markets.2)(3)(4

National fresh fruit supply is protected since 1950. The free import of fresh fruit that is produced in the country is not allowed. The permanence of this agricultural policy measure resulted in an internal price higher than the export parity with equal or lower quality than the external offer5. The continuity of this policy made small producers to focus on supplying the internal market and, in turn, it was not a stimulus to consolidate changes that allowed to increase access and competitiveness in the external markets. As a consequence, the sector was more vulnerable to economic, financial or environmental impacts.6)(7

Without removing the aforementioned protection, between 2006 and 2012 there was a change in agricultural policy inspired by the concept of development with equity8, the state intervened in the system supporting groups of organized producers, inserted in the territory with the special aim of including the family producer (FP) in the agroindustrial and export chains9. The FPs simultaneously comply with: being a natural person that directly manages an agricultural holding and together with their family they carry out the productive activity. They hire up to two permanent non-family employees or their equivalent in day-wages (250 wages per person), occupy a maximum area of 500 hectares CONEAT 100 index, under any form of tenure, reside on the farm or less than 50 kilometers away, and if there is extra property family income, it is less than 14 Contribution and Benefit Base (CBB), an administratively fixed value equivalent to $ U 3340 as of December 2016. Producers who met the requirements and registered at the Ministry of Livestock, Agriculture, and Fisheries (MGAP by its Spanish acronym) obtained a registration number that identifies them in the FP Registry of the MGAP.7

Support funds for the agricultural sector come from the application of the value-added tax for selling fruits, vegetables and flowers imported or commercialized in large areas as established by Law 17503/200210. Subsequently, two laws, 17844/200411 and 18827/201112, created the instrument Business Plans (BP) to comply with the mandate to integrate FP into industrial and agro-export value chains, stimulate the use of agricultural insurance and reduce debt.

The BP instrument aims to strengthen the links between those involved in commercialization. Apart from the market, information on the demand and production strategy are shared in the value chain so as to respond to it13)(14. The chain´s government is regulated by formal and informal mechanisms15; all the actors should have win-win relationships13)(16, emphasizing the need to have written contracts as a transparency guarantee to avoid deviations17.

Description of the business plan instrument

The calls to present BP and the evaluation of the documents delivered were responsibility of the Support Unit of Agroindustrial Projects of the Farm (UAPAG by its Spanish acronym), and when approved they signed a contract with the General Farm Management (DIGEGRA by its Spanish acronym) office, dependent on the MGAP, in charge of releasing payments and supervising the process. The BP were characterized by the benefits for the producers and the actors involved.

The expected benefits were non-reimbursable funds granted as a fixed price per kilogram of fruit traded within the BP, and zero-rate financing for the purchase of inputs or the payment of technical assistance required for the fulfillment of the BP. To access the price supplement, it was required to have a pre-harvest contract signed with a commercial agent; the producer was the beneficiary of the subsidy and the final amount of money received depended on the delivered and accepted volume at the collection plant.

The actors involved in the BP were sponsors, commercial agents, technical advisors, and producers. The sponsor or promoter of the BP was an independent private agent with a commercial initiative that organized the contracts between producers and commercial agents, they were related to the DIGEGRA and ultimately responsible for the contractual compliance with public administration. The commercial agent was responsible for the purchase of the contracted volumes. The producer, final subject of the policy, had to deliver the contracted volume to the commercial agent with the specified quality and received the financial benefits. The technical advisor, appointed by the sponsor, assessed the producer to achieve the quality and quantity required by the contract, their wages could be co-financed with DIGEGRA funds.

Available records

In the 2006-2012 period, UAPAG received and evaluated according to consistency, coherence and relevance criteria the BP presented by the sponsors, in addition, payment fulfillment of the previous financing was evaluated. A contract was generated between the sponsor and DIGEGRA when the BP was approved. All documentation was filed along with information on fund releases and returns related to the agreement.

In the BP file, the identity information of each producer was included, as well as the FP registration number of the MGAP. The other actors were described by their name or business name along with the contact details. In the BP description, at least sector, commercial destination (industry, export), production process and justification of the expenditure of funds requested as refundable support were reported. The BP had a copy of all contracts signed between the producer and the commercial agent, where the volume or area committed was reported.

Research problem

Annual sales planning of industry and export agents was hindered by the lack of pre-harvest contracts with the producers, on the other hand, the intermediation in the domestic market affected the prices the producer received. Facing these problems, it is proposed as a working hypothesis that the stimuli offered in the BP instrument would be sufficient to facilitate integration into agroindustrial and export chains through contracts signed by the FP and with the help of the subsidy the price per kilo received by the FP would increase. The research aimed to evaluate the effectiveness of the policy instrument called «Business Plans» in deciduous fruit trees, as a tool for the inclusion of FP in export or agroindustrial value chains.

The effectiveness criterion is evaluated through the FP performance in three aspects that contribute to the growth of a value chain: evidence of involvement in more than one call, existence of recurrent links with their sponsors or commercial agents, and fair benefit distribution for all members of the BP, whether they are FP or non-family producers (non-FP). A qualitative assessment of the perception of the benefits received by the participation is also added, both for commercial reasons and other results obtained.

Material and Methods

This study is designed as a non-experimental, transversal and correlational-causal type18, it includes both the analysis of the 57 BP in DFP approved between 2006 and 2012, and filed in the UAPAG of DIGEGRA as semi-structured interviews aimed at a random sample of participating producers.

The document submitted by a sponsor, in a call year, with an ordinal number assigned by the MGAP, was defined as the BP analysis unit. If the same sponsor had more than one BP with the same group of producers in the same call, but with a different contract with the MGAP, it was considered a different BP.

The producers of the approved BP were identified by their identity card (ID) for the study purposes. Each ID represented a different producer, the relationship between an ID and a specific contract in a BP is considered a participation event. The participating producers are classified as FP (they have a registration number that identifies them) and non-FP.

The policy instrument effectiveness should be measured objectively by comparing the proposed target indicators at the beginning of the instrument application with the results obtained during the implementation19)(20. In the case of the BP, there is no target indicator, so effectiveness can only be inferred through collateral aspects that contribute to the target.

In the present study, the effectiveness was inferred from the course of the FP within the BP. If evidence shows that FP behave in the same way as the non-FP in terms of frequency and type of participation, commercial destination, connection quality and perception of benefits, the hypothesis that BP effectively include FP in value chains is accepted. There can also be unexpected results20, so the evidence of a favorable opinion to the instrument in the FP will also be used as an effectiveness criterion.

The BP commercial destinations were industry (IND), Brazil export (EXP B) and European Union export (EXP E). IND are those BP where the final production destination is in the domestic market to intermediaries (people) or DFP processing industries; EXP B are BP of various sectors of DFP for fresh consumption or industrial use in Brazil; EXP E, are BP of apples and pears for fresh consumption in the European Union of specific varieties and with quality standards of product and process demanded by consumers of the destination country.

The course of FP and non-FP was analyzed by means of contingency tables, the comparison of means was carried out using the Mann and Whitney test and the Chi-square independence analysis was performed with the statistical software Stat Tools for Excel. An α=0.05 was considered in all cases.

To identify the sponsors, an alphanumeric label was created where the letter P was associated with the alphabetical order number of the business name; the same was done for the commercial agents but preceded by AC. If the sponsor had more than one role, only the sponsor tag was used.

Sponsors were grouped according to the criteria of non-business and business, the first grouped BP presented by rural development societies, producers associations and cooperatives, the second grouped the BP presented by business names that identified companies. Commercial agents were grouped in companies when a business name was identified and in intermediaries when only a name was mentioned.

The financial information was evaluated according to the approved and executed amounts expressed in constant Uruguayan pesos as of December 2016. Annual amounts were grouped and adjusted by the annual average of the Consumer Price Index per year.

The semi-structured survey to assess producer satisfaction was applied to a sample of 21 producers, selected by simple random sampling without replacement among all the IDs that were associated with an area involved in the BP.

The minimum sample size was defined for a 90 %confidence with an accuracy of 1 ha for the surface variable, and to meet that requirement a sample of 21 ID was sufficient among the 510 registered; the members of the sample explained the 14% of the participation events within the 1251 observed. The sample was composed of 8 non-FP and 13 FP.

The consultation was centered on the perceived benefits, the possible reasons not to fulfill a signed contract, the importance of the subsidy and the pre-harvest price to continue participating in the calls, improvement proposals for BP management. The requested answers were referred to as the perception of the participation group in BP. Annex I includes a detail of the survey.

Results

294 producers (58 %) out of the 510 linked to the BP repeated their participation in successive calls. In the FP subgroup (162), 63 integrated a BP again.

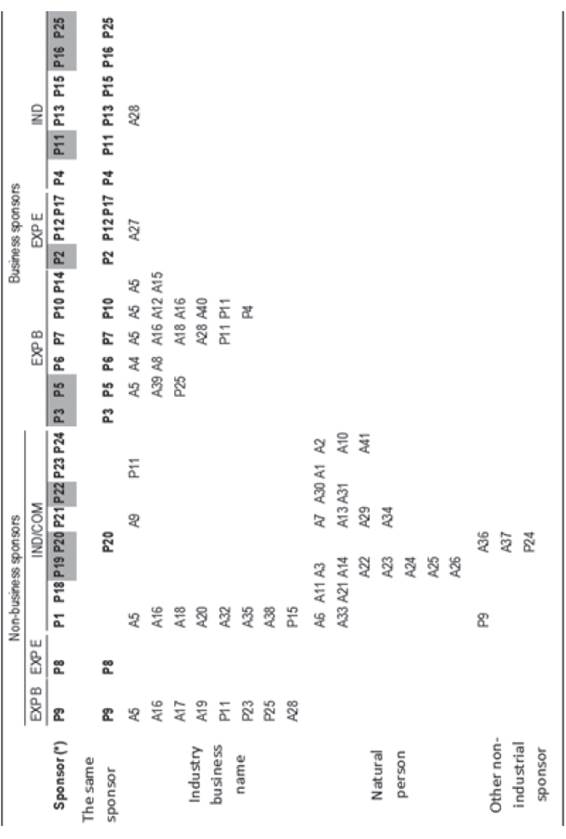

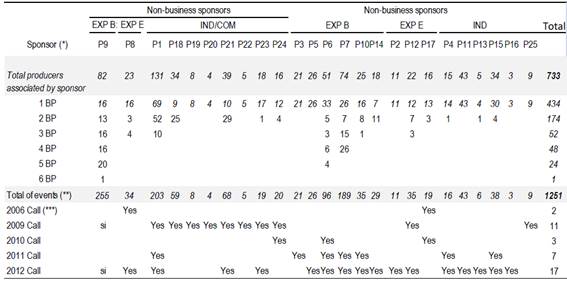

In the 2006-2012 period, 57 BP were approved, presented by 25 sponsors, Table 1 groups according to sponsor’s type and destination of the BP, total number of presented BP, number of participants, number of events financed by the MGAP (sum product of the number of producers by the times each participated) and the years in which their BP were approved.

Table 1: Producers distribution according to the sponsor’s type and destination of the BP with detail of the producers’ repetitions and the calls in which they participated.

Producers related to more than one sponsor since the total sum of participants per sponsor (733) is greater than the number of producers identified by CI (510). Producers participated in the BP between 2 and 6 times and this explains the 1251 events registered. On average, the BP have 30 producers (coefficient of variation (CV) = 98 %). 35 % of the 1251 events respond to a single participation in BP. 2012 was the year with the highest number of participating sponsors (17 in 25). The participation of the sponsors was 2 BP on average with a CV of 61 %.

675 out of the 1251 events were from producers related to 10 non-business sponsors, three are producer associations (P1, P8, and P9) that worked with apple and pear, P8 and P9 destined 43 % for export, the other seven are rural development companies (P18, P19, P20, P21, P22, P23, P24) that offered several DFP sectors to industries.

On the other hand, the 15 sponsors grouped as businesses explained 576 events, 461 related to export and 115 to the industry. Nine sponsors presented EXP E BP (P2, P12, and P17) and the remaining six were EXP B. In the six IND BP, the sponsors were industries that presented quince BP (P4, P11, P13, P15, P16, and P25) and several of them also operated as commercial agents in other DFP BP destined for industry.

Producers’ course

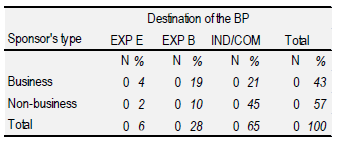

A relevant aspect of the policy was the inclusion of family producers in agroindustrial and export value chains. Family producers explained 257 of the 733 sponsor/producer relationships, the percentage distribution according to the sponsor’s type and destination of the BP is presented in Table 2.

Considering the sponsor’s type, 57 % of the FP related to non-business and considering the destination, 65 % were involved in IND BP; only 6 % participated in EXP E BP.

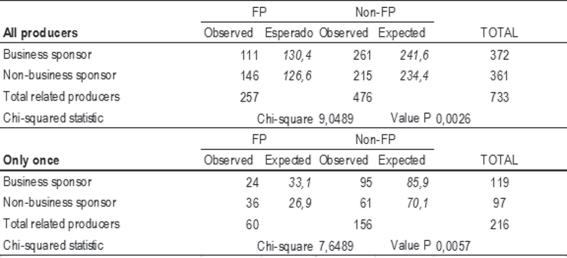

The FP preferred to relate to non-business sponsors and the non-FP with business sponsors as shown in Table 3.

Table 3: Contingency table between the sponsor’s type and the producer type for the group of producers and for those who participated only once.

The Chi-square test result for all producers (Chi-square value of 9.0488 and a P-value of 0.00263) indicates that the producer type and the sponsor’s type are not independent. The conclusion is the same when evaluating those who participated only once and the corresponding Chi-square test values are 7.6489 for a P-value of 0.0057.

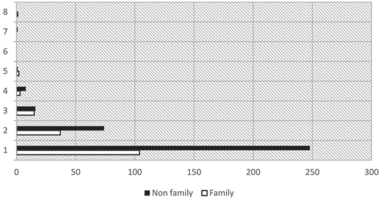

Both FP and non-FP preferred to interact with few sponsors, most of them up to two, as shown in Figure 1.

Figure 1: Number of sponsors related to each producer according to FP or non-FP in the 2006-2010 period.

69% (352 producers) of the 510 producers related only to one sponsor and 91 % of the producers with up to two. The remaining 9 % showed multiple alliances (the maximum is a FP related to 8 sponsors, followed by a non-FP with 7 different sponsors and also both with multiple contracts with the P9 sponsor). FP and non-FP data that generated figure 1 were evaluated through the Mann and Whitney test with P value of 0.9591 and 5 % of significance. It indicates that both populations have equal bond heterogeneity.

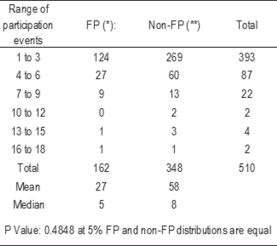

The producers participated in several events, with a minimum of one and a maximum of 17. Table 4 shows the distribution in ranges of 3 amplitude events.

Table 4 shows that, between 2006 and 2012, 77 %did not participate in more than 3 events, the participation media for the FP was 5 events and 8 for the non-FP, both groups have equal distribution between classes according to the Mann-Whitney test that shows a P = 0.4848 at 5 % significance.

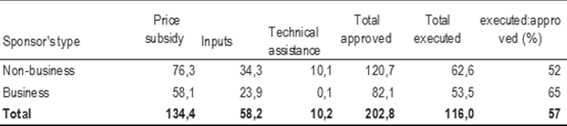

Approved and executed funds

The approved BP in the period under study meant the approval of 203 million Uruguayan pesos (constant pesos as of December 2016) destined for DFP. The average execution of these funds was 57 %, so the producer actually received 116 million, as shown in Table 5.

Table 5: Fund distribution according to the requested destination in the BP and the sponsor’s type (data in thousands of $U as of December 2016).

The largest amount of money approved was destined to the non-business sponsors BP (121 of the 203 million were equivalent to 60 % of the total), of that amount, 63 %was for price subsidy and 52 % was executed. For the business sponsors BP, 82 million were approved (40 %of the total 203 million), 70 % of which was allocated to the price supplement, executing a 65 %.

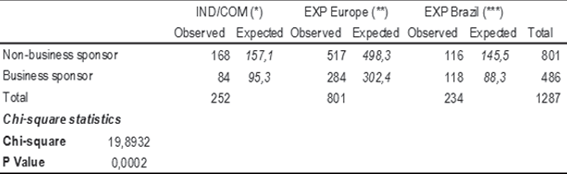

The amounts the producers received depended on the sponsor’s type and the BP destination as shown in Table 6.

Table 6: Average amounts each producer received according to sponsor’s type and product destination.

The Chi-square value of 19.8932 and a P-value of 0.0002 allow establishing dependence between the variables. Producers related to producer associations that presented BP for EXP E received the largest amounts and the IND BP presented by businesses represented the lowest amounts. In the first-named, the average amount received per producer and per event is 517 thousand pesos and in the last 84 thousand pesos.

The relationship with commercial agents

The export BP sponsors were in addition commercial agents in their BP. Regarding the EXP E BP, the sponsors were the only commercial agents except for one case. The EXP B, simultaneously carried out export and industry BP, associating in each BP with several industries according to sector and industry type (juices, beverages, and sweets). The detail of relationships is shown in Table 7, for sponsors grouped by type and BP destination.

The IND BP of P1 and the EXP B BP were characterized by multiple relationships with commercial agents since their BP involved all DFP sectors. The BP presented by the development societies were characterized by relating to intermediaries. Some sponsors participate as commercial agents of other BP, in this way, P11 presented only one BP but was a commercial agent in 4 different BP, likewise the business sponsors P15 and P25 had two roles, all of them were food processing industries. On the other hand, non-business sponsors were listed as commercial agents of other BPs, such as P9, P23, and P24.

Benefits perceived by the producers

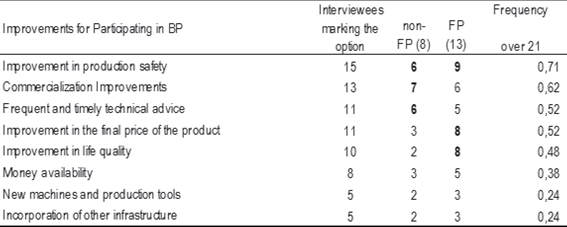

The survey carried out to the producers showed policy acceptance, the benefits perceived are presented in Table 8. The 21 interviewees were asked to indicate all the items they considered were fulfilled. The result was discriminated according to FP and non-FP, the later all members of the EXP E chain.

Table 8: Absolute and relative frequency of the benefits associated with the BP among the producers interviewed.

The three most mentioned benefits by the non-FP are the improvements in production safety, in the commercialization and the technical assessment, the FP also mentioned in the first place the production safety but they differ in the other two where, they point out the improvement in the final price and life quality.

The production safety in the non-FP referred to the quality assurance in certified productions for fresh export to Europe, this allowed an improvement in commercialization and access to technical assistance by collaborating in the financing of the referring technician. On the other hand, FP associate security with financing that allowed the reduction of structural debt and also the possibility of accessing climate insurance coverage. The FP also related security to money availability and the possibility of incorporating improvements in infrastructure aspects, therefore, they point out improvements in life quality as a second important point.

Export producers mentioned the importance of financing the necessary inputs, especially traps, for the integrated pest control foreseen in the BP 2011/2012. This measure facilitates the commercialization in foreign markets where the use of insecticides is not admitted.

The price improvement, one of the instrument objectives, was indicated only by 13 of 21 producers, 7 non-FP and 6 FP. Even when indicating improvements in commercialization 12 in 21 responses mentioned that the received final prices were not good, especially in IND and EXP B BP, they felt that the subsidy was a hidden discount at the time of defining the contract, since the producer price was established as an industry price plus subsidy and the first was lower than the usual market one. Others showed distrust in the classification process when delivering in bulk because in their opinion the quality rejections were excessive and most of the fruit was not admitted to receiving the subsidy. These explanations were not associated with the producers that operated in EXP E BP.

Despite price opinions, the producers did not consider retaining production or breaching the contract even when the price was unfavorable, the main reason expressed for not delivering the entire product was the lack of volume with sufficient quality, basically due to climatic reasons, although debt payments to suppliers with product was also mentioned.

None of the interviewees perceived that the commercialization relationships changed, defining them as antagonistic among the members of the BP. It was not mentioned that commercial agents suggested changes in production to improve commercialization except the need to have certain varieties to participate in EXP E-type businesses.

Results discussion

The BP gave financial support to all producers with structural and financial difficulties, but their main objective was to promote conditions for the FP to integrate value chains. Value chains differ from simple commercial chains by the existence of stable relationships between actors, transparency and shared information and the equitable distribution of benefits among its members21. Based on these characteristics, it is assumed that the BP was an effective policy if the results show that FP participated repeatedly, with stable commercial relationships, perceiving the same benefits as the non-FP and without evidence of asymmetric commercial relationships between the actors.

FP participated in more than one call, but non-FP did more than FP, they maintained contact with the same sponsor or with the same commercial agent when the sponsor did not operate anymore.

FP preferred calls aimed at the domestic market (commercialization of 2009 and calls for industrialization) and these BP were led by non-business sponsors (rural development societies, cooperatives) as opposed to the non-FP that participated in export and industry BP with business sponsors. The financial results for the producers were different according to the sponsor’s type, businesses had better performing BP and the participating producers obtained greater income from the fruit price subsidy; on the other hand, non-businesses requested more financing for input and technical assistance but obtained lower income from the fruit price subsidy. In sum, it is considered that the instruments offered by the MGAP were attractive to the participating producers since the participation and stability of relationships are fulfilled, but the distribution of benefits was not equal between the FP and the non-FP, therefore, the effectiveness is partial.

In a value, chain benefits are shared among all chain links and they act with transparency. The participating FP in IND BP where industries themselves were the sponsors noted dissatisfaction in the commercial relationship -the subsidy operated as a disguised discount price paid in the treatment plant, or delivered products always had a high level of rejection in the plant while those from the packing plant always had excellent performance. These responses indicate the presence of antagonistic relationships typical of a simple supply chain13 and not of a value chain. Dabezies and others14 do not refer to the supply chain industry as an example of a value chain in Uruguay. Business sponsors and commercial agents associated in order to have a predictable fruit supply in season. Since they have a dominant position in the chain, they also had the possibility of appropriating the subsidy indirectly when managing the price on contracts and establishing quality conditions to access the higher price. Including FP in their BP would respond only to a bureaucratic requirement and not intended to formalize long-term relationships. On the other hand, the IND BP presented by producer organizations lead to interpret their motivation was to leverage financing for technical assistance and inputs required by FP rather than for changes in the way of entering the market as can be observed from the results of tables 1 and 5.

Rural development societies understood the needs of the FP better and are more able to motivate participation and lift their restrictions. Faílde and others3 described the fruit FP as producers who reside on the premises occupying most of their time in productive activities, are older than 50 years old and have low level of education. Producer organizations allowed to lift the restriction of reading and interpreting business contracts when having a low educational level providing also the transparent environment to formalize the connection with commercial agents, a necessary condition for an effective relationship22. In the case of the IND BP, it can be observed that despite the different businesses’ motivations, associations were formed around specific stimuli and without a shared future project, and therefore has no long-term results23.

The relationship between apple and pear producers for export to Europe is different, this destination is supplied with 10 to 15 large producers who have the facilities to perform all commercial preparations and service of commercial intermediation to about 300 small producers who deliver products for their classification, packaging and commercialization with no contract and in relationships based solely on trust, being able to constitute a potential value chain3)(14. The EXP E BP would be the reflection of this group, presented by the P2, P8, P12 and P17 sponsors who are also commercial agents as shown in Table 7. The EXP E BP stand out as those who received the largest amount of money provided to the sector (Table 6). Only 4 % of the FP associated with these BP (Table 2), the low FP participation can be explained by the fact that trading implies having specific varieties, including irrigation and adhering to all the production requirements established by quality standards in processes and products demanded by European buyers. The support instruments established in the BP were not enough to lift the restrictions of technical order (varieties, irrigation, quality of product and process). On the other hand, changes in varieties imply moving away from the local consumer preferences and producing with higher restriction and control as required by the internal market to adjust to safety and environmental care requirements. Neven24 points out that part of the difficulties to achieve these technical changes is due to the presence of a closed domestic market that protects the producer and ensures to sell their product even with low quality.

Business sponsors with EXP B BP act as intermediaries between the IND BP and EXP E BP covering all DFP sectors, with greater emphasis on apple, pear, and peach. Sponsors that operated in this market presented simultaneously EXP B BP and IND BP with the same group of producers requesting subsidy for both destinations. P9 is the most outstanding operator. They are associated with most participation events, but with the lowest percentage of execution and the lower amount for participation events.

Restrictions by variety were not as relevant in EXP B BP as in the case of EXP E BP, since the fruit went to factories and not to the direct consumer. The main restriction was associated with sanitary and environmental requirements due to the presence of codling moth and grapholita as well as the presence of pesticide residues25. In the year 2012, a special call was included for the widest coverage in the territory of these pest control techniques by sexual confusion, a recommended but voluntary practice26. In the same year, 17 out of 25 sponsors presented IND, EXP B and EXP E BP where everyone requested financial support for trap purchase.

Conclusions

Uruguay has an emerging value chain for the supply of apple and pear varieties for Europe. The quality requirements in process and product of European markets only allow the access of a small proportion of the FP. Most FP were included in BP in calls for industry, internal commercialization or export to Brazil, the absence of value chains for these markets made the stimuli offered in the DIGEGRA BP ineffective to integrate FP in value chains.

FP reiterated their participation in successive calls to BP with links between stable agents, but the involvement way indicates that most of the participants did not do so, as a way of changing the commercialization chain, but to take advantage of specific financial stimuli. Relationships between producers and commercial agents in these commercialization chains were antagonistic and actors with greater relative power in the chain could appropriate subsidy price by how the price was established in contracts.

FP show satisfaction with the instrument because it improved their life quality, reduced debt and allowed them to produce with greater security by facilitating access to climate insurance. The non-Fs are satisfied with the tool for the improvement in marketing by improving their income from the subsidy, share security in production through access to insurance and highlight support for technical assistance.