Serviços Personalizados

Journal

Artigo

Links relacionados

Compartilhar

Ciencias Psicológicas

versão impressa ISSN 1688-4094versão On-line ISSN 1688-4221

Cienc. Psicol. vol.11 no.2 Montevideo nov. 2017

https://doi.org/10.22235/cp.v11i2.1491

Original Articles

Preliminary study of the comparative profile of financial control in university young people

1Facultad de Psicología, Universidad del Valle de México drjpalacios81@gmail.com

2Facultad de Estudios Superiores Zaragoza. Universidad Nacional Autónoma de México lexhiveleonardo@gmail.com

Abstract: The objective of the present research was to obtain evidences of validity and reliability of the scale of locus of financial control, obtaining differences in structural variables. The study involved 300 university students, 110 men and 190 women, between 18 and 59 years old (M = 21.74; SD = 6.7) from the Metropolitan Zone of Mexico City. The locus of control was assessed with items that reflect that obtaining money is contingent on its actions. The results show the psychometric properties of an instrument that incorporates three factors related to the locus of control: internal, affective and external. Additionally, the findings suggest that university students have a higher level of internal and affiliative financial locus of control, differentiated by sex, type of career and level of work efficiency. The discussion analyzes the utility of the results within the Mexican socioculture, that having money is attributed to affective causes, external sources, as well as the decision to own money, which has implications when seeking new income and the contingencies to have it

Key Words: economics psychology; locus of control; personal finance; youths; psychological assessment

Resumen: El objetivo de la presente investigación fue obtener evidencias de validez y confiabilidad de la escala de locus de control financiero, además de analizar diferencias en variables estructurales. Participaron en el estudio 300 universitarios, 110 hombres y 190 mujeres, entre 18 y 59 años de edad con una media de 21.74 (DE = 6.7) de la Zona Metropolitana de la Ciudad de México. El locus de control se evaluó con ítems que reflejan que obtener dinero es contingente con sus acciones. Los resultados muestran las propiedades psicométrica de un instrumento que incorpora tres factores referentes al locus de control: interno, afectivo y externo. Además los hallazgos sugieren que los universitarios tienen un alto locus de control financiero interno y afiliativo, diferenciado por sexo, tipo de carrera y nivel de eficiencia laboral. La discusión analiza la utilidad de los resultados dentro de la sociocultura mexicana, es decir, que lograr tener dinero es atribuido a causas afectivas, fuentes externas, así como por la decisión propia de tener dinero, lo que tiene implicaciones al momento de buscar nuevos ingresos y las contingencias para tenerlo

Palabras clave: psicología económica; locus de control; finanzas personales; jóvenes; evaluación psicológica

Introduction

Every day people strive to exercise some degree of control over the facts they consider valuable in their lives, thus achieving personal, family, social and financial actions. These actions take on importance depending on the attributions of success or failure that individuals assign to them in their daily lives. For these attributions, Rotter’s theory of social learning (1966, 1975, 1990) describes that between situational and environmental reinforcers mediate cognitive factors, is based on the assumption that cognitive factors help to determine how people will react to the reinforcers of their environment and it is personal expectations that ultimately determine the behavior.

An individual’s behavior may be due to the environment in which he lives or to the individual’s ability to modify his or her situation. This personality trait is called locus of control, which describes two forms of behavior control through internal or external reinforcement and to the degree that an individual considers that reinforcements are contingent upon their behavior (Diaz-Loving & Andrade, 1984). For Bandura (1994), control refers to the possibility of dominating an event as the control locates inside or outside of itself. In this way people have learned that reward or success depends on their actions and the control they have over their lives, these people have a locus of internal control. While others consider that events in their life are determined by factors outside their control such as luck, destiny or situations, these people have an external locus of control (Cázares & Berridi, 2000; Perry & Morris, 2005; Rotter, 1975, 1990; Rotter & Mulry, 1965).

Several studies (Diaz-Guerrero, 1994; García & Reyes, 2000, Laborin, Vera, Durazo, & Parra, 2008; Triandis & Suh, 2002) have pointed out that countries with individualist cultures have an internal locus of control, with a collectivist culture the locus of control is outsourced. In the first instance, the control locus was considered as a one-dimensional construct, characterized by a continuum of two poles, the more external a person is, the less internal the inverse will be (Rotter, 1975, 1990); however, different studies in Mexico (Correa, Bedolla, & Reyes, 2006; Díaz- Loving et al., 1984; García et al., 2000; La Rosa, Díaz- Loving, & Andrade, 1986; Vera & Cervantes, 2000) have shown that construct the locus of control is multidimensional, finding between 3 and 5 dimensions (eg 1. internal locus of control, 2. external locus of control, 3. affective / affiliative locus of control, 4. social / familial locus of control, and 5. personal locus of control). Apparently the Mexican people besides having the typical factors of internality and externality incorporates a clearly affective dimension in its control, since it integrates the qualities of its culture, being obedient affiliative, affectionate and courteous with the others, adding a style of self-modification to adapt to their environment (Díaz-Guerrero, 1994). When considering the characteristics that Mexicans (Palacios & Martínez, 2017) and its importance for this culture, it is relevant that for the present research the affective / affiliative dimension was integrated (García et al., 2000; La Rosa et al., 1986; Vera & Cervantes, 2000) within the financial locus of control, as a way of attributing to oneself the reasons for having good interpersonal relationships and that facilitates the achievement of goals (income), thanks to the affective relationships established by the person.

On the other hand, the locus of control has been applied to different situations such as school (Camacho, Moreno, & Hernández, 1994; Gonzalez, Corral, & Maytorena, 2002), environmental (Bustos, Flores, & Andrade, 2004), the politician (Bedolla & Mena, 2004), the partners relationship (Montero, Rivera, Reyes, & Díaz -Loving, 2008), risk behaviors (Riccio-Howe, 1991), health care (Leong, Molassiotis, & Marsh, 2004; Stenström & Adersson, 2000), and the economy (Plenkett & Buehner, 2007), however, in our country there is no evidence that indicates the application of the locus of control in the finances of the people. Personal finance is a relatively recent subject within psychology (Cruz, 2001; Quintanilla, 1998) and the present study approaches it from the perspective of young people, considering that individual behaviors are based on the history of their reinforcement (Kimble, Hirt, Díaz-Loving, Hosh, Lucker, & Zárate, 2002) and in their own abilities to control or modify important events in their lives (Palacios, 2011).

Research on economic psychology has focused on defining its concepts (Alejo, Rojas, & Pérez-Acosta, 2008), understanding social cognition (Crusius Van Horen, & Mussweiler, 2012), economic thinking (Amar, Abello, Denegri, & Llanos, 2007), the attitudes towards indebtedness (Boddinton & Kemp, 1999; Denegri, Cabezas, Del Valle, González, & Sepúlveda, 2012), the financial motivation (Rowley, Lown, & Piercy, 2012), the behavior of the consumer (Samuel-Lajeunesse & Gil, 2014), the strategies to manage money (Palacios, 2014), personality traits (Palacios, Bustos, & Soler, 2015) and in some models (Rodríguez, 2006) include economic, social and personal factors that affect the buying behavior.

As for personal factors, it is emphasized that studies based on social learning theories have served to explain different behaviors (Dijkstra & De Vries, 2000; Palacios, 2010; Palacios, 2015; Palacios & Parrao, 2010; Wilson-Barlow, Hollins, & Clopton, 2014). From this perspective, the behavior is largely determined by the events of the individual’s experience and their consequent interaction with their social environment (Ardila, 2011; Galindo & Ardila, 2012; Lipina & Colombo, 2009). Particularly research based on these theories (Bandura, 2001; Rotter, 1966) consider that the behavior of people is linked to expectations of reinforcement, the action on the problem (self-efficacy) and control over reinforcements (internal - external locus of control).

The research of locus of control in economics and finance are approximations in studies such as those of Furnham (1986) who elaborated a scale of locus of control of the economic conduct. Lindstrom & Rosvall (2013) linked higher economic stress to the lack of locus of internal control. Lachman & Weaver (1998), associate the locus of internal control with a high sense of well-being, in addition to pointing out that the locus of internal control is beneficial for all socioeconomic levels. The authors explain that despite the adversities typical of the situation of poverty, there are people who achieve a high level of motivation to achieve, as well as a sense of control and this result in their quality of life. On the other hand, Haider & Naeem (2013) identified differences in the locus of control of Pakistani students, where the women showed an external control, while the men an internal control. Regarding university students, Baguma & Chireshe (2012) identified that a locus of internal economic control is influenced by age, while being female and having a locus of internal economic control negatively predicted belief in the power of others to influence one’s economic performance.

The theories of social learning have allowed us to understand different behaviors through various researches (Bandura, 2002; Gwaltney, Shiffman, Norman, Paty, Kassel, Gnys, Hickcox, & Balanbis, 2001; Palacios, 2011; Palacios & Bustos, 2012a, b; Palacios & Bustos 2013; Palacios & Ramírez, 2016; Stuart, Borland, & McMurray, 1994). These studies have focused on studying the effect of self-efficacy on the actions performed by individuals and to a lesser extent have studied the control that people have over situations and necessary behaviors to change their situation of poverty or to maintain better personal finance. On the other hand, in the last years a sector of the population that is interested in knowing its financial practices are the university students, specifically by the increase of the indebtedness considering the risk that implies for the financial and labor life (Denegri et al., 2012). For this reason, the objectives of the present research were to obtain evidence of validity and reliability of the locus scale of financial control, in addition to obtaining differences in demographic variables such as, sex, type of university, type of career and occupation, as well as in financial variables (credit card use and level of efficiency in work and / or academic), in a sample of Mexican university students.

Material and Method

Sample

A non-probabilistic sample was intentionally selected from 300 university students, 110 men and 190 women, ranging in age from 18 to 59 years, with a mean of 21.74 (SD = 6.7), from different places in the Metropolitan Area of the City from Mexico. The 50.3% were from a public university and 49.7% from a private university. The 54.7% belonged to biological, social and health orientations and the remaining 45.3% were from the economic and administrative orientations. Regarding their occupation, it was found that 71% only studied, 26.3% studied and worked, and only 2.7% were working only after they finished their studies. In addition they were asked about the use of credit cards, the 22.3% said that they had a credit card and 74% mentioned not having one.

Measures

The locus of financial control was defined as the degree to which an individual considers that his personal finances are contingent on his actions, that is, the conduct of obtaining money can be controlled internally, it can be due to affective causes or it can be determined by external factors.

In order to evaluate this construct, 9 items were written with five options of closed response type Likert scale that go from (5) completely agree to completely disagree (1). The locus of financial control was written considering the three main factors found in Mexico: financial locus of internal control (eg. I decide when to have money), financial locus of external control (eg. Having money depends on the destination) and affective financial locus of control (e.g. Getting money depends on how people like me). The items were written considering that their content was congruent with the social learning approach (Bandura, 2005; Rotter, 1975; Rotter, Chance, & Phares, 1972) and could reflect the contingencies by which people consider that they can have money, in order to obtain the validity of content at the instrument.

In addition, the instrument included socio-demographic data related to being male or female, age, type of university to which they belong (public or private), the career they study, their main activity (study, work or both), perception of their efficiency (labor and / or academic) and a question on the handling of credit (have or not credit cards).

Procedure

The instrument was applied to the university students in a grouped way, using the school groups for this purpose. They were asked to respond to a questionnaire designed to know some activities related to finances that university students do. They were asked to respond honestly, explaining that their answers would be used for research purposes.

Ethical considerations

All participants were informed that their participation was voluntary and that the information was anonymous, they were guaranteed the confidentiality of the data provided and their doubts were resolved. The informed consent of the participants and the school authorities was used. The research protocol was established according to the Regulation of the General Health Law, in its section on research in human beings (Secretaría de Salud, 2011).

Results

In order to evaluate the psychometric characteristics of the financial control scale proposed for this study, the item-total correlation of the items within their respective dimension was reviewed. We found low to moderate relationships of each item within their respective dimension (internal, affective and external) of financial control. In order to obtain content validity, in addition to including the total item correlation, the conceptual clarity of each dimension was considered.

To obtain the construct validity of the instrument used, an exploratory factorial analysis of principal axes with orthogonal rotation and forced to three factors was performed to obtain the grouping of the items as proposed in previous studies (Correa et al., 2006; Díaz- Loving et al., 1984; García et al., 2000; La Rosa et al., 1986; Vera & Cervantes, 2000). The adequacy of correlation matrices was evaluated using the Kaiser-Meyer-Olkin (KMO) sample adequacy index, obtaining a value of 0.718 considered as acceptable. The Bartlett’s Sphericity Index was significant (X 2 = 702.882; gl = 36; p <.001) indicating the relevance of performing the factor analysis. The eigenvalue was considered to be greater than 1.0. (see table 1).

The obtained factorial solution explains 49.10% of the total variance. The internal consistency analysis (Cronbach’s Alpha coefficient) for the instrument total showed an index of 0.62 (95% CI = .55 - .68).

Subsequently, Spearman Brown correlations were made between the factors of the instrument, to assess the degree of association between each one of them. The table 2 shows that internal financial control is negatively and significantly related to external financial control, but not to affective financial control that does not show a relation. Affective financial control is positively and significantly related to external financial control.

Table 3 shows the descriptive statistics of the subscales, where it is observed that the highest score is for the internal financial control, followed by affective financial control and, finally, the lowest average score is the external financial control. The same table shows the reliability levels, where it is emphasized that affective financial control and external financial control have an acceptable reliability, but not for the internal financial control that its level of reliability is below that allowed.

The normal distribution of the score of each factor of the financial control locus was examined, and it was found that it was not statistically normal according to the Kolmgorov-Smirnov (K-S) test.

The internal control locus showed an Asymmetry = -813, a Kurtosis = .622 and a K-S value (gl = 300) = .138, p = .000. The locus of affective control had a Asymmetry = .663, a Kurtosis = .049 and a value of K-S (gl = 300) = .111, p = .000. The external control locus presented a Asymmetry = 1.09, a Kurtosis = 1.50 and a value of K-S (gl = 300) = .139, p = .000. The existence of the absence of normality in the distributions is essential to ensure the maximum internal discrimination of the subjects with respect to the underlying continuum of financial control and to ensure its continuity metric with the empirical data obtained.

Table 4 shows the comparisons through the Mann-Whitney U test of the financial control locus and the demographic variables (sex, type of academic area and university). Statistically significant differences were found between men and women, the men score highest only in the affective financial locus compared to women; that is, the men to get money use relationships with other people to get it. Students in the private university and those in the economic and administrative areas have a greater internal financial locus, that is, these types of university students, decide when to obtain money and consider that having money depends on the actions they take to obtain it, compared to the university students of the public university or with a university student studying in the biological and social areas. In the case of the affective and external financial locus, the students obtained scores in a similar way.

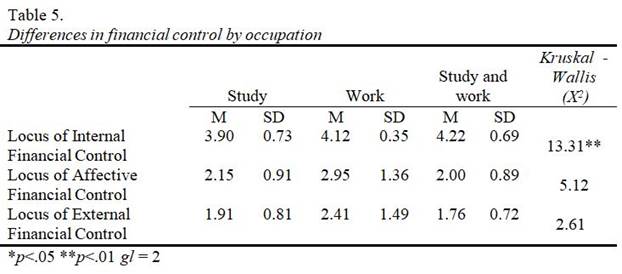

In addition, a nonparametric variance analysis (Kruskal - Wallis), between the type of financial control and the occupation, found statistically significant differences, where the students who study and work, have a greater internal financial locus compared with those who only study and those who only work have a greater affective financial locus compared to those who study and work (see table 5).

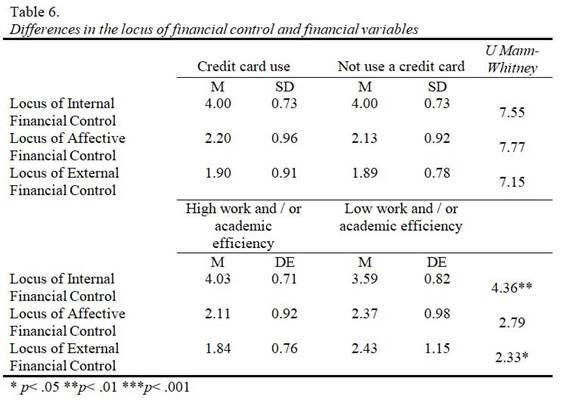

When obtaining the differences in the financial (credit card use) and labor (efficiency in the things they do) variables, it was found that there are no statistically significant differences between university students using credit cards and those who do not use them, regarding their financial control, whether internal, emotional or external. To know the differences in the level of efficiency in work and / or academic activities, two groups (high and low labor and / or academic efficiency) were carried out from the median. It is observed that those who show greater efficiency in the activities they perform have greater internal financial control, as opposed to those with low efficiency. In contrast, external financial control showed significant differences in favor of those who consider that they have low levels of efficiency in the activities they carry out, compared to those with a high level of efficiency (see table 6), in other words, someone who is more efficient has an internal financial locus and who is less efficient has an external locus.

To obtain validity of a criterion, a logistic regression was used to estimate the proportion of the financial control locus in the level of efficiency (high or low) in the activities (labor and / or academic) carried out by young people. The results obtained showed that the internal financial control was estimated to be 1.6 times higher for young people with high efficiency than those with low efficiency (OR = 1.6; IC 95% = 0.9 - 2.8, p <.05); with a correct percentage of classification of 92.3% and a pseudo R2 of Negelkerke = 0.10. Considering the percentage of variance obtained, the model suggests as a possible explanation that those considered to be highly efficient in their activities are more likely to generate money for themselves.

Discussion

The evaluation of people’s control over money was measured by factors that describe a set of actions to obtain money. The measurement of the locus of control construct in this study showed that it is possible to measure it through three factors that are consistently present in Mexico. Derived from the exploratory factor analysis it can be observed that the first factor obtained, adjudges the achievement of money to affective causes (locus of affective financial control); the second factor refers to external causes such as luck (locus of external financial control); the last factor indicates that having money is attributed by its own decision (locus of internal financial control). The structure of these three factors is similar to that found in other studies (Correa et al., 2006; Díaz-Loving et al., 1984; García et al., 2000; La Rosa et al., 1986; Vera et al., 2000) who find dimensions referring to the causes by which people assign responsibility for their behavior.

It is important to point out that in relation to the factorial analysis, it showed the structure previously reported in México (Correa et al., 2006; Díaz- Loving et al., 1984; García et al., 2000; La Rosa et al., 1986; Vera et al., 2000), however, the third item of the locus of internal financial control has a low structural weight, despite the above, it was decided to keep it considering its theoretical relevance. This finding indicates the relevance of reviewing the meaning of the item, as well as the inclusion of new items that more accurately reflect the construct.

Considering that the factor of internal financial control has difficulties in its factorial weight, it seems advisable to reflect on some disadvantages that were presented in the instrument and that will have to be solved for future studies. 1) Include a greater number of items to explore the different dimensions of the control locus as has been found in previous studies in Mexico (Garcia et al., 2000; La Rosa et al., 1986; Vera & Cervantes, 2000). 2) Regrouping the itmes differently, for example considering only two dimensions of the locus of control (internal and external). Although not reported in the study, a new factor analysis was tested under this latter idea. The result showed clarity in the structure of the locus of affective financial control and for the locus of internal financial control, but not for the locus of external control, which mixed with the locus of affective control, which seems to indicate that in a factorial structure of only two factors, would be obtaining an external locus of control oriented to the affiliative financial locus, rather than one oriented to the exclusive externality, as shown in the correlations made (see table 2). With this evidence, from our perspective, the alternative to be followed in the future is to increase dimensionality to the construct of financial control locus aimed at incorporating a fourth dimension of the locus of financial control but of a social type, so that the lack of consistency of the item “to have money depends on the effort of the people” could be understood that the word “people” refers to “other people”, which would lead to “having money depends on the effort of the other people” as family or friends so that in the future could be written as an item of external locus and not of internal locus or even better as an item of financial locus of social control. These considerations should be addressed for future studies.

As for the internal consistency analysis, the scale obtained a Cronbach’s Alpha of .62 for the total instrument, which is considered a low level of reliability, so the items of each factor should be reviewed in order to improve its content, increase their reliability and incorporate a greater variety of behaviors related to internal, external or effective contingencies (a minimum of five items per factor) to get money between people. It is necessary to increase the reliability levels of each factor, specifically in the factor of internal control, specifically if it is intended to link the scale obtained with variables of economic psychology or with psychosocial variables.

The scale presented in this study can be an effective instrument to characterize the way college students in Mexico consider the most viable way to obtain money. This measurement allows to have a more detailed understanding of the obtaining of money in this population segment. From this perspective the research carried out in this study extends the construct validity of the internal, external and affective locus of control, but now applied to the way of obtaining money.

The levels of correlation per factors showed that financial control of affective type and external financial control are linked, that is to say, for college students who are in situations where getting money depends on how people like you (affective control), it is a matter of destiny or the luck to achieve it (external control) or the fact of pleasing people is an external way to obtain money. The negative correlation of internal control with external control seems to indicate that when people use their own effort to have money (internal control), they consider that obtaining money by means of luck or destiny is not contingent with their actions, which diminishes the hope to obtain it by this means. The relation between the external locus of control and the affiliative locus seems to find support in the characteristics of the Mexican culture (Diaz-Loving & Andrade, 1984), which describes the manipulation of the environment through affiliative capacities and communicative aspects of the subject. This affiliative control requires a type of confrontation compatible with the Mexican’s self-modifying style (Díaz-Guerrero, 1994). In addition, Kimble et al. (2002), mention that manipulating the environment through others, is equivalent to controlling our destiny, that is, an affective control.

In addition, performing the mean analyzes of each subscale, the students obtained the highest score in the internal financial control locus (3.99), followed by affective control (2.18) and finally the external locus (1.88). The results obtained for correlations and the analysis of means, seem to indicate that despite the higher means in internal financial control, the learning contingencies to obtain money from Mexican university students (less in this sample), is an external and socio-affective tendency. These results (higher score of internal financial control) supports what is indicated by Perry & Morris, (2005) regarding better financial behavior in those with locus of internal control, and seem to contradict the conclusions of some authors (Díaz-Guerrero, 1994; García et al., 2000; Laborín et al., 2008; Triandis et al., 2002) by pointing out that countries with collectivist cultures have an external locus of control. The above seems to indicate that the Mexican youth society represented in this sample by university students, when they are under certain situations, perceive that the internal contingencies control the way they obtain money.

The comparative profile of the locus of financial control in university students indicates that affective financial control is higher in university men, that is, men consider that in order to have money it is necessary to use their affiliative and communicative skills with other people for the purpose of with the purpose of making money. The above agrees with Haider et al. (2013), as well as with Denegri et al. (2012), who mention that gender is one of the significant predictors of discrimination between those who use credit cards and which are more indebted, compared to those who have fewer credit cards and are less indebted.

The differences of internal financial control in favor of the private university and of the economic-administrative orientations, means that the university students of these areas of knowledge have received training under which they perceive that they are able to control the contingencies that elicit having money on their own account, in addition to being able to decide the right time to earn money, as well as attributing their financial success to their efforts and abilities, all this is contrary to what the public school students do when they have training linked to social and health orientations; the above corroborates its importance and its subsequent study with the use of credit instruments that are granted to university students, whether in administrative or economic areas or in social and health areas, in the latter, attention should be focused on that university policies could use it in favor of better economic levels or, as Denigri et al. (2012) point out, progressively increase their differential indebtedness patterns with age, in which formal sources of indebtedness can exist (merchants and credit cards) and informal as friends and family.

In the transition from being a student or being a student and working at the same time, being only an already graduated worker, there is a transformation in values, personal expectations or contingencies in the way of obtaining money, that is, university students who study and work, have internal financial control by attributing that having money depends on their own effort and is reinforced by performing two activities (study and work) at the same time. In the case of university students who only work, they have transferred the exclusive utility of an internal control to an affective financial control, that is, they attribute their financial success to the social relations that establish with whom the individual relates or in particular contexts (Díaz-Guerrero, 1994; Laborín et al., 2008; Palacios, 2011; Vera & Cervantes, 2000), as in this case, the labor market. This is partially supported by studies of university populations (Amar et al., 2007; Boddinton & Kemp, 1999; Denegri et al., 2012: Palacios, 2014; Rodríguez, 2006) that show the potential influence of future expectations. This implies that for college students, current indebtedness can be considered a transient situation that allows them to support their current lifestyle, but that would be overcome once they increase their income when leaving university.

When obtaining the differences in the financial variables (credit card use and efficiency classification in the things they do), it was found that there are no differences among university students who use credit cards with respect to their financial control, whether internal, affective or external, but not for the level of efficiency in the activities they perform have greater internal financial control, that is to say, they consider that obtaining money depends on themselves. The first one opens two possibilities, the first one indicates that in this sample the obtaining of money depends exclusively of its efficiency to obtain it, and second, that to use a credit card does not depend exclusively of contingent actions to obtain more money. The last possibility requires more research in this area to have clarity of the use and understanding that give college students to credit cards.

The results found have implications for the personality of Mexicans, because the application and development of the control locus is influenced by sociocultural factors (Correa et al., 2006; Díaz-Guerrero, 1994; Díaz-Loving et al., 1984; García et al., 2000; La Rosa et al., 1986; Palacios et al, 2011; Palacios et al., 2016; Vera et al., 2000), which elicit the way in which reinforcers are perceived to be contingent on behavior. In this sense, in the future it will be possible to investigate the effect of socio-cultural factors in the locus of financial control. The previous research done in Mexico (Correa et al., 2006; Díaz-Guerrero, 1994; Díaz- Loving & Andrade, 1984; La Rosa et al., 1986; Rotter, 1975, 1990; Vera et al., 2000) has shown differences in the contingencies of reinforcement, whether produced by the own behavior (internal control) or by contingencies of reinforcement determined by luck or others (external control) as well as by contingencies of affective reinforcement (affective control).

It is important to point out some limitations of the study, one of them possibly the most important one is found in the instrument, particularly because of the low levels of reliability in the factor of internal control, so that in future studies it will be necessary to increase the number of items in order to improve the internal consistency of the instrument, in order to obtain more accurate and reliable results. Another limitation has to do with the size of the sample, so for future studies it will have to be expanded, as well as replicate the study in various samples in order to corroborate the theoretical structure of the financial control locus instrument, its reliability and their linkage with economic behavior. Before concluding with the limitations, it seems relevant to mention that in the case of a preliminary study, the conclusions should be taken with caution considering that the results are not yet definitive as it is a preliminary study, so that its application will have a lesser scope.

At this point, it seems relevant to mention that due to the psychometric difficulties found in the instrument, new research ideas are opened, for example: is it appropriate to build a new scale that measures locus of financial control? or could an existing one that has good psychometric properties be adapted? Three answers can be found to these questions. The first one is to continue using the scale presented in this study without modifications, which we consider not the most convenient. Second, to review the results obtained in the present study and adjust what is necessary in order to improve the instrument, which would be part of the contribution of this preliminary study in the development of this evaluation instrument and third, choose to carry out the adaptation of another scale already existing that has adequate psychometric properties to measure the locus of financial control in the Mexican culture.

As a conclusion it can be pointed out that what was found in the present study indicates that young people differ in the value of the reinforcer, depending on the situations under which they perceive as contingent to obtain money or not to do it. But these situations are differentiated by socio-demographic aspects, such as being a man, being a student of a private university, studying careers of an economic-administrative area and being efficient in the activities they perform, which are distinguishable aspects of the locus of control, that is, a locus of internal and affective control, with which, the young people obtaining money according to their own decision to obtain it.

Referencias

Amar, J., Abello, R., Denegri, M., & Llanos, M. (2007).Pensamiento económico en jóvenes universitarios. Revista Latinoamericana de Psicología, 39(2), 363-373. [ Links ]

Alejo, R. A., Rojas, A. P., & Pérez-Acosta, A. (2008). Psicología y asuntos económicos: una aproximación al estado del arte. International Journal of Psychological Research, 1(1), 49-57. [ Links ]

Ardila, R. (2011). El mundo de la psicología. Bogotá: Manual Moderno. [ Links ]

Bandura, A. (1994). Social cognitive theory and exercise of control over HIV infection. In: DiClemente, R. J. and Peterson, J. L. (Eds.). Preventing AIDS theories and methods of behavioral interventions (pp. 89-116). New York: Plenum Press. [ Links ]

Bandura, A. (2001). Social Cognitive Theory: An agentic perspective. Annual Review of Psychology, 52, 1-26. [ Links ]

Bandura, A. (2002). Environmental sustainability by sociocognitive deceleration of population growth. En P. Schmuck & W. Schultz (Eds.). Psychology of Sustainable Development (pp. 209-238) Massachussetts: Kluwer Academic Publishers. [ Links ]

Bandura, A. (2005). Guide for constructing self-efficacy scales. En: Pajares, F. & Urdan, T. (Ed.). Self- efficacy, belief of adolescents (pp. 307-337). USA: Age Publishing. [ Links ]

Bedolla, R. B., & Mena, G. J. (2004). Relación de voto duro con autoeficacia y locus de control. La Psicología Social en México, 10, 563-569. [ Links ]

Baguma, P., & Chireshe, R. (2012). Predictors of economic locus of control among university students in Uganda. Journal of Psychology in Africa, 22(2), 279-282. [ Links ]

Boddinton, L., & Kemp, S. (1999). Student debt, attitudes towards debt, impulsive buying, and financial management. New Zealand Journal of Psychology, 28(2), 89-93. [ Links ]

Bustos, A, J. M., Flores, H. M., & Andrade, P. P. (2004). Predicción de la conservación de agua a partir de factores socio-cognitivos. Medio Ambiente y Comportamiento Humano, 5(1 y 2), 53-70. [ Links ]

Camacho, V. M., Moreno, C. S., & Hernández, R. A. (1994). Locus de control, escolaridad de los padres y rendimiento académico en adolescentes. La Psicología Social en México , 5, 31- 36. [ Links ]

Cázares, C. A., & Berridi, R. R. (2000). Multidimensionalidad del locus de control a los 8 y 9 años de edad. La Psicología Social en México , 8, 121- 126. [ Links ]

Correa, R. F., Bedolla, R. B., & Reyes, L. I. (2006). Estructura del control personal. En: Sánchez, A. R., Díaz-Loving, R. y Rivera, A. S. (Eds.). La Psicología Social en México (pp. 66- 72), Vol. 11, México: AMEPSO. [ Links ]

Crusius, J., van Horen, F., & Mussweiler, T. (2012). Why process matters: A social cognition perspective on economic behavior. Journal of Economic Psychology, 33, 677- 885 [ Links ]

Cruz, J. (2001). Psicología económica. Suma Psicológica, 8(2), 213-236. [ Links ]

Denegri, C. M., Cabezas, G. D., Del Valle , R.C., González, G.Y., & Sepúlveda, A. J. (2012). Escala de actitudes hacia el endeudamiento: validez factorial y perfiles actitudinales en estudiantes universitarios chilenos. Universitas Psychologica, 11(2), 489-509. [ Links ]

Díaz -Guerrero, R. (1994). La Psicología del mexicano (6a ed.). México: Trillas. [ Links ]

Díaz- Loving, R., & Andrade, P. P. (1984). Una escala de locus de control para niños mexicanos. Revista Interamericana de Psicología, 18(1 y 2), 21-33. [ Links ]

Dijkstra, A., & De Vries, H. (2000). Clusters of precontemplating smokers defined by the perceptions of the pros, cons and self-efficacy. Addictive Behaviors, 25(3), 373- 385. [ Links ]

Furnham, A. (1986). Economic locus of control. Human Relations, 39(1), 29-43. [ Links ]

Galindo, O., & Ardila, R. (2012). Psicología y pobreza. Papel del locus de control, la autoeficacia y la indefensión aprendida. Avances en Psicología Latinoamericana, 30(2), 381-407. [ Links ]

García, C. T., & Reyes, L. I. (2000). Estructura del locus de control en México. La Psicología Social en México , 8, 158-164. [ Links ]

González, L. D., Corral, V. V., & Maytorena, M. A. (2002). Modelo estructural de locus de control escolar. La Psicología Social en México , 9, 276-281. [ Links ]

Gwaltney, C., Shiffman, S., Norman, G., Paty Kassel, J., Gnys, M., Hickcox, M., & Balanbis, M. (2001). Does smoking abstinence self efficacy vary across situations? Identifying context- specificity with the relapse situation efficacy questionnaire. Journal of Consulting and Clinical Psychology, 66, 516- 527. [ Links ]

Haider, Z., I., & Naeem M. (2013). Locus of control in graduation students. International Journal of Psychological Research , 6(1), 15-20. [ Links ]

Kimble, C., Hirt, E., Díaz-Loving, R., Hosh, H., Lucker, G. W., & Zárate, M. (2002). Psicología Social de las Américas. México: Pearson Educación. [ Links ]

La Rosa, J., Díaz- Loving, R., & Andrade, P. P. (1986). Escalas de locus de control: problemas y contribuciones. Revista Mexicana de Psicología, 3(2), 150-153. [ Links ]

Laborín, Á. J., Vera. N. J., Durazo, S. F., & Parra, A. E. (2008). Composición del locus de control en dos ciudades latinoamericanas. Psicología desde el Caribe, 22, 63-83. [ Links ]

Lachman, M., & Weaver, S. (1998). The sense of control as moderator of social class differences in health and well-being. Journal of Personality and Social Psychology, 74, 763-773. [ Links ]

Leong, J., Molassiotis, A., & Marsh, H. (2004). Adherence to health recommendations after a cardiac rehabilitation program in post-myocardial infarction patients: the role of health beliefs, locus of control and psychological status. Clinical Effectiveness in Nursing, 8(1), 26-38. doi: 10.1016/j.cein.2004.02.001 [ Links ]

Lindstrom, M., & Rosvall, M. (2014). Economic stress and lack of internal health locus de control: A life course approach. Scandinavian Journal of Public Health, 42(1), 74-81. doi: 10.1177/1403494813504503 [ Links ]

Lipina, S. J., & Colombo, J. A. (2009). Poverty and brain development during childhood: An approach from cognitive psychology and neuroscience. Washington, D. C: American Psychological Association. [ Links ]

Montero, S. N., Rivera, A. S., Reyes, L. I., & Díaz -Lovíng, R. (2008). Adaptación de la escala de locus de control para parejas.. En: Rivera, A. S., Díaz-Loving, R. Sánchez, A. R. y Reyes, L. I (Eds.). La Psicología Social en México (pp. 621- 624), Vol. 12, México: AMEPSO . [ Links ]

Palacios, D. J. (2010). Autoeficacia e intención conductual del consumo de tabaco en adolescentes: validez factorial y relación estructural. Adicciones, 22(4), 325-330. [ Links ]

Palacios, D. J. (2011). Las conductas de riesgo del adolescente. México: Centro de Investigación e Innovación Biopsicosocial, AC. [ Links ]

Palacios, D. J. (2014, Junio). Psicología económica y comportamiento de consumo. Segundo Coloquio de Psicología efectuado en la Universidad Humanitas, México. [ Links ]

Palacios, D. J. (2015). Estimación psicométrica de la escala de autoeficacia ante conductas de riesgo para adolescentes en México. Psychosocial Intervention, 1, 1-7. [ Links ]

Palacios, D. J. & Bustos, A. J. M. (2012a). Modelo de autoeficacia y habilidades ambientales como predictores de la intención y disposición proambiental en jóvenes. Revista Intercontinental de Psicología y Educación, 14(2), 143- 163. [ Links ]

Palacios, D. J., & Bustos, A. J. M. (2012b). La teoría como promotor para el desarrollo de intervenciones psicoambientales. Psychosocial Intervention , 21(3), 245- 257 [ Links ]

Palacios, D. J., & Bustos, A. J. M. (2013). Validez factorial de la autoeficacia ambiental y su influencia estructural sobre la conducta proambiental en jóvenes. Revista Iberoamericana de Evaluación en Psicología, 35(1), 95-111. [ Links ]

Palacios, J. R., Bustos, J. M., & Soler, A. L. (2016). Personalidad en diferentes niveles del comportamiento de compra. En: Rivera, A. S., Díaz-Loving, R., Reyes, L. I. y Flores, G. M. (Eds.). Aportaciones Actuales de la Psicología Social (pp. 414- 420), Volumen III. México: AMEPSO . ISBN: 978-607-96539-1-0. [ Links ]

Palacios, D. J., & Martínez, M. R. (2017). Descripción de características de personalidad y dimensiones socioculturales en jóvenes mexicanos. Revista de Psicología, 35(2), 453- 484. [ Links ]

Palacios, D. J., & Parrao, L. M. (2010). Intención, habilidades y eficacia para predecir el uso del condón. En: Rivera, A. S., Díaz-Loving, R., Sánchez, A. R., y Reyes, L. I. (Eds.). La Psicología Social en México (pp. 267- 272), Vol. 13, México: AMEPSO . [ Links ]

Palacios, D. J., & Ramírez, A. V. (2016). Estudio comparativo de la autoeficacia saludable en las conductas alimenticias de riesgo. Revista Psicología Iberoamericana 24(2), 17-25. [ Links ]

Perry, V. G., & Morris, M. D. (2005). Who is in control? The role of self perception, knowledge, and income in explaining consumer financial Behavior. Journal of Consumer Affairs, 39(2), 299-313. [ Links ]

Plunkett, H. R., & Buehner, M. J. (2007). The relation of general and specific locus of control to intertemporal monetary Choice. Personality and Individual Differences, 42, 1233-1242. doi:10.1016/j.paid.2006.10.002 [ Links ]

Quintanilla, P. I. (1998). La psicología económica y del consumidor en España. Reflexiones conceptuales y práctica profesional. Papeles del Psicólogo, 70, 48- 54. [ Links ]

Rodríguez, V. J. (2006). Validación del modelo psicoeconómico del consumidor. Pensamiento y gestión, 20, 1-54. [ Links ]

Rotter, J. B. (1966). Generalized expectancies for internal versus external control of reinforcement. Psychological Monographs, 80, 1-26. [ Links ]

Rotter, J. B. (1975). Some problems and misconceptions related to the construct of internal versus external control of reinforcement. Journal of Consulting and Clinical Psychology , 43(1), 56-67. doi: 10.1037/h0076301 [ Links ]

Rotter, J. B. (1990). Internal versus external control of reinforcement: A case history of a variable. American Psychologist, 45(4), 489-493. [ Links ]

Rotter, J. B. & Mulry, R. C.(1965). Internal versus external control of reinforcement and decision time. Journal of Personality and Social Psychology , 2(4), 598-604. doi: 10.1037/h0022473 [ Links ]

Rotter, J. B., Chance, J. E., & Phares, E. J. (1972). Applications of a social learning theory of personality. England: Oxford, Holt, Rinehart & Winston. [ Links ]

Riccio-Howe, L. (1991). Health values, locus of control, and cues to action as predictors of adolescent safety belt use. Journal of Adolescent Health, 12(3), 256-262. [ Links ]

Rowley, M., Lown, J., & Piercy, K. (2012). Motivating Women to Adopt Positive Financial Behaviors. Journal of Financial Counseling and Planning, 23(1), 48-62. [ Links ]

Samuel-Lajeunesse, J. F., & Gil Juárez, A. (2014). Psicología económica y del comportamiento del consumidor. España: Editorial UOC. [ Links ]

Secretaría de Salud. (2011). Reglamento de la Ley General de Salud en Materia de Investigación para la Salud. Recuperado de http://www.salud.gob.mx/unidades/cdi/nom/compi/rlgsmis.html [ Links ]

Stenström, U., & Andersson, P. (2000). Smoking, blood glucose control, and locus of control beliefs in people with Type 1 diabetes mellitus. Diabetes Research and Clinical Practice, 50, 103-107. doi: 10.1016/S0168-8227(00)00169-8 [ Links ]

Stuart, K., Borland, R., & McMurray, N. (1994). Self-efficacy, health locus of control, and smoking cessation. Addictive Behaviors , 19(1), 1-12. [ Links ]

Triandis, H., & Suh, E. (2002). Cultural influences on personality. Annual Review of Psychology , 53,133-160. doi.org/10.1146/annurev.psych.53.100901.135200 [ Links ]

Vera, J., & Cervantes, N. (2000). Locus de control en una muestra de residentes del noroeste de México. Psicología y Salud, 10(2), 237-247. [ Links ]

Wilson-Barlow, L., Hollins, T., & Clopton, J. (2014). Construction and validation of the healthy eating and weight self-efficacy (HEWSE) scale. Eating Behaviors 15, 490-492. doi: 10.1016/j.eatbeh.2014.06.004. [ Links ]

Received: February 05, 2017; Revised: June 23, 2017; Accepted: August 10, 2017

texto em

texto em